Knowledge Base

-

Getting Started

- Install and Activate

- Turn on Manage Stock in WooCommerce

- Notes on Inventory Level Initialization

- For Fast Performance

- Multi-User Considerations

- Importing and Exporting Data

- Migration from ATUM

- Security

- Company Information

- Tax

- Foreign Currencies

- Loading Average Costs

- Serial/Lot Tracking

- Automatic Document Numbering

- Modify ApeksOPS to Suit Your Exact Needs

-

General Usage

-

The ApeksOPS Business Process

-

The ApeksOPS Dashboard

-

Tax

-

-

- Articles coming soon

-

- Articles coming soon

-

-

-

Customizing ApeksOPS

-

Import from Excel

-

View Consolidated Profits

< All Topics

Print

VAT Notes

Posted

Updated

Bynathan

Goods that you purchase may fall into three categories:

- Normal VAT

- Exempt (i.e. VAT on purchases can be deducted from payment to government).

- Zero-rated (no VAT payable, but must still be reported)

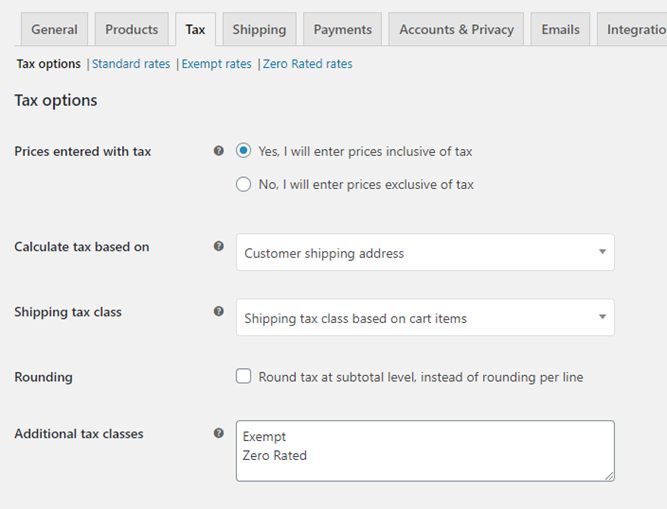

So that ApeksOPS can separate these, set up Exempt and Zero-rated as “Additional tax classes” in your WooCommerce Tax settings:

You will need to set the VAT rate (e.g. 20%) for both the “Standard rates” and “Exempt rates” classes after you save the settings. (See “Standard rates” and “Exempt rates” links at the top of the Tax tab).

You will also need to set the Tax status and Tax class on each of your Products in WooCommerce (Note: Zero-rated products should have their Tax status set to “Taxable” so that they will show on tax reports):

Table of Contents